The Genius Act and Stablecoins: How They Work, and Implications for U.S. Treasuries

A guest post by our Finance and Economics correspondent

Editorial note: this is not a financial advice. This article provides educational information on stablecoins and the so-called “Genius Act”.

The GENIUS Act, which stands for Guiding and Establishing National Innovation for U.S. Stablecoins, is a piece of legislation that has successfully passed through the Senate in June 2025. This act aims to establish a federal regulatory framework for stablecoins, which are digital currencies typically pegged to the value of the U.S. dollar. The bill received bipartisan support, passing with a vote of 68-30 and setting the stage for a final vote. Under the GENIUS Act, the Department of Treasury gains significant authority in regulating stablecoins, potentially allowing banks, fintechs, and retailers to issue their own stablecoins.

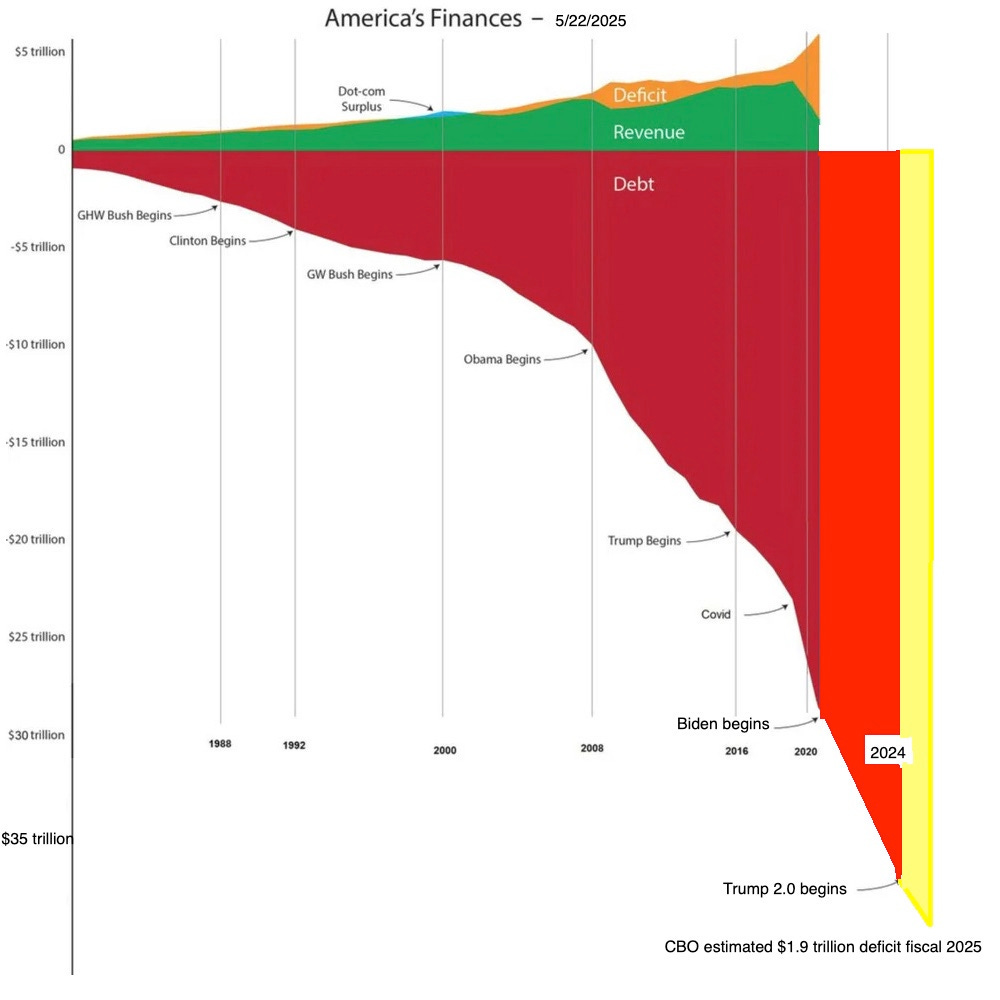

I asked a friend who is more proficient in finance than I am to contribute an article on this topic. My executive summary of this - stablecoins are just a fancy name for store credit that is not processed by credit card issuers (i.e. Visa, MasterCard, Amex, etc), and thus make more profit to the issuers of the store credit. These are not “new” currencies, nor are they “stable”, despite what the name says - they are backed by fiat and US Treasuries, i.e., they are fiat and unstable, just like the US dollar. That is the main point of the Genius Act - cramming more US Treasuries into the private sector because nobody wants to buy toilet paper on the international markets and Trump needs to fund his regime somehow. That is the main motivation behind the Genius Act, however, additional factor is further solidifying digital money and control grid. And as you can see, this is not just Trump’s problem, this is every administration’s problem. Currently, the US gov debt is $37T, however, including “unfunded liabilities” (i.e. pension and healthcare promises that the US federal and state government cannot possibly meet) it is $150T! Are you surprised that the regime is so eager to murder the claimants of those liabilities under the guises of “targeted protection” and other Orwellian slogans?

Below is what my Finance and Economics correspondent writes about stablecoins and "the “Genius Act” (stable genius, har-har):

What Are Stablecoins and How Do They Work?

Stablecoins are a category of cryptocurrencies designed to maintain a stable value by pegging their price to an asset, often a fiat currency like the U.S. dollar. Unlike volatile cryptocurrencies such as Bitcoin or Ether, stablecoins aim for near-zero price fluctuation, combining the efficiency of blockchain with the predictability of traditional money. To achieve stability, most stablecoins are backed by reserves or collateral and have mechanisms to ensure they can be redeemed 1:1 for the asset they track (for example, 1 token = $1 USD). When designed and managed properly, holding a stablecoin is functionally like holding an equivalent amount of cash, but in digital form on a blockchain.

There are several types of stablecoins, distinguished by how they maintain their peg and what kind of collateral (if any) they use:

Fiat-Collateralized (USD-Backed) Stablecoins: These are the most common stablecoins. They are directly pegged to a fiat currency (usually USD) and backed one-for-one by reserves held in cash or cash-equivalent assets. For example, USD Coin (USDC) and Tether (USDT) are pegged to the dollar and collateralized by assets like bank deposits, money market funds, and short-term U.S. Treasury bills. Issuers typically hold $1 (or equivalent) in reserve for each stablecoin issued, so that users can redeem the token for real dollars on demand. This reserve-backed model ensures stability as long as the issuer’s assets remain high quality and equal to the outstanding tokens.

Crypto-Collateralized Stablecoins: These stablecoins are backed by other cryptocurrencies rather than fiat. Because crypto assets are volatile, these systems are often over-collateralized – meaning users must deposit more value than the stablecoins they receive (to absorb price swings in the collateral). A prime example is Dai (DAI), which is created by users locking up crypto (like ETH) in a smart contract. If the collateral value falls too much, automated mechanisms liquidate it to protect the peg. Crypto-backed stablecoins thus maintain stability through excess collateral and smart-contract enforcement, trading decentralization for some capital inefficiency and complexity in their design.

Algorithmic Stablecoins: Algorithmic stablecoins seek to hold a peg without direct collateral, using software rules to expand or contract the token supply based on demand. They often operate in tandem with a secondary token or governance system to absorb volatility. For instance, some algorithmic models will mint and sell a sister token if the stablecoin price is above $1, or buy back and burn tokens if the price falls below $1. While innovative, these designs have proven fragile in practice. A notable example was TerraUSD (UST), which attempted to use algorithms and a linked token (LUNA) to stay at $1. TerraUSD’s failure in 2022 – when it spiraled far below its peg – illustrated the high risk of algorithmic approaches without robust collateral. Even “fractional” hybrids like Frax (FRAX), which combine partial collateral with algorithmic adjustments, face challenges maintaining long-term confidence. Overall, purely algorithmic stablecoins remain experimental and can collapse if market psychology turns against them.

Commodity or Asset-Backed Stablecoins: Some stablecoins use tangible assets as a reference. For example, there are gold-backed tokens (each token redeemable for a fixed amount of gold in a vault) like PAX Gold, and others tied to commodities like silver or real estate. These give investors price-stable crypto exposure to the underlying asset. However, commodity-pegged coins are a smaller niche compared to currency-pegged stablecoins.

U.S. Treasury-Backed Stablecoins: An emerging category uses short-term U.S. government debt (Treasury bills) as the primary reserve asset. These stablecoins function almost like tokenized money market funds. For example, Ondo’s USDY or Hashnote’s USYC are backed by portfolios of Treasury bills and repurchase agreements, and they pay yield directly to holders (reflecting the interest earned on Treasuries). By holding only high-quality liquid assets like T-bills, these tokens aim to be very safe and even interest-bearing. This makes them attractive to investors seeking a digital dollar with some return, though they operate within regulatory guidelines to ensure the reserves are transparent and compliant. In effect, Treasury-backed stablecoins blur the line between a traditional money market fund share and a cryptocurrency, offering the stability of government-backed assets with the 24/7 transferability of crypto.

In all cases, the core mechanism is that stablecoin issuers or protocols maintain sufficient collateral value to honor redemptions at par. This backing can be verified through attestations or on-chain data. Well-designed stablecoins also have arbitrage incentives that encourage traders to correct the price if it drifts from $1 (for example, if a coin falls to $0.99 on exchanges, arbitragers can buy it cheap and redeem for $1 of collateral, making a profit and restoring the peg). Thanks to these designs, stablecoins have become a foundational piece of the crypto market – they facilitate trading, serve as a safe harbor during volatility, and are increasingly used in payments and remittances due to their reliability.

Why U.S. Businesses Are Interested in Stablecoins for Payments

Large U.S. retailers and other businesses have taken notice of stablecoins as a potential game-changer in payment processing, primarily because of cost and speed advantages over traditional card payments. In the current system, whenever a customer pays with a credit or debit card, the merchant pays interchange fees (also known as “swipe” fees) to banks and card networks (Visa, Mastercard, etc.). These fees typically range around 2%–3% of every transaction – a significant expense, especially for high-volume retailers. For giants like Walmart or Amazon, those fees add up to billions of dollars per year skimmed off their revenue. By contrast, stablecoin payments can be processed on blockchain networks for a tiny fraction of that cost (potentially just pennies in network fees), bringing digital transactions “as close to cash” as possible in terms of cost. In other words, accepting a dollar via a stablecoin could cost essentially nothing, whereas accepting that same dollar via a card might cost 2–3 cents in fees – a huge difference at scale.

Another motivation is settlement speed and finality. Card payments take a couple of days to settle – after you swipe your card, the merchant typically doesn’t receive the funds in their bank account until T+1 or T+2 days, and there is a window for chargebacks or reversals. During that lag, big retailers effectively extend credit to the payment system and lose the opportunity to earn interest on those funds. Stablecoin transactions, by contrast, settle within seconds or minutes on-chain and are irreversible with cryptographic finality. This near-instant settlement means a merchant’s money is locked up for far less time. For cash flow–intensive businesses, faster access to funds and reduced risk of chargebacks are very attractive. One estimate noted that large retailers miss out on an “astounding amount” of interest because of the slow settlement of card payments – a gap that fast-settling stablecoins could close. Additionally, the blockchain operates 24/7, so there are no cutoff times or weekend pauses; a stablecoin payment on a Sunday night is as immediate as one on Tuesday at noon.

Beyond cost and speed, stablecoins offer new revenue opportunities for businesses, especially if they issue their own. Retailers are exploring whether they could launch proprietary stablecoins (either alone or as a consortium) for customer payments. If, say, Amazon or Walmart issued a “WalmartCoin” pegged to the dollar, customers might preload money into it (converting cash or card payments into the stablecoin) and then spend it at that retailer. The crucial incentive for the company is that they get to keep the float – the cash backing those stablecoins sits in their reserves. Like a bank or a money market fund, the retailer could invest those reserves in safe assets (Treasuries, etc.) and earn interest on every dollar customers park in their coin. This interest income could be substantial, essentially turning payments into a profit center instead of a cost center. In effect, big merchants issuing stablecoins would be capturing the kind of revenue that today flows to banks (interest on deposits) and card networks (interchange fees). A recent report noted that if retailers band together to issue a stablecoin, the interest earned on customer deposits would become “an all new source of profit” for them. This prospect of saving on fees and earning on float is a powerful double benefit.

To illustrate the level of interest: Walmart and Amazon – the two largest U.S. retail companies – have both reportedly explored launching their own stablecoins or accepting existing stablecoins at checkout. The Wall Street Journal broke the story in mid-2025 that these titans are looking into stablecoin payment options as a way to sidestep traditional payment rails. The rationale is straightforward: if customers pay using a Walmart or Amazon stablecoin (or a third-party stablecoin like USDC), the retailer could save a sizable chunk of the fees that would otherwise go to Visa/Mastercard. According to that report, not only are Walmart and Amazon examining this, but other large companies such as Expedia (online travel) and some major airlines have also considered issuing or using stablecoins for payments. This represents a broad corporate interest in breaking free from the card networks’ fee structure.

Regulatory developments are encouraging this trend. U.S. lawmakers are on the cusp of passing the first comprehensive guidelines for stablecoins, which would legally enable private companies to issue their own dollar-pegged crypto tokens. In particular, the proposed “GENIUS Act” in the Senate would establish a clear framework for approving and supervising stablecoin issuers. The bill would require that any company issuing a payment stablecoin maintain 100% reserves in high-quality liquid assets (like cash or Treasury bills) and meet certain disclosure standards. This legislation has been moving forward (it passed an initial committee vote in mid-2025), signaling that Congress sees value in letting private-sector stablecoins flourish under oversight. The expectation of a green light from Washington has undoubtedly emboldened companies like Walmart and Amazon to prepare stablecoin strategies, knowing they could soon have legal certainty. It’s telling that after the news of their exploration broke, Visa and Mastercard’s stock prices dipped by 4–5%, reflecting investor realization that the card giants could face a serious threat to their fee-based model.

Key advantages of stablecoin payments for businesses include:

Dramatically Lower Transaction Costs: Blockchain-based payments can reduce or eliminate the 2–3% interchange fees that merchants currently pay on card transactions. A well-designed merchant stablecoin system might only incur negligible network fees (especially on efficient blockchains) and perhaps a small fee to a wallet provider – potentially bringing costs close to zero per transaction. For example, one analysis highlighted that stablecoin networks could process payments for as low as 0.1–0.5% of the transaction (or even less on some chains), versus ~3% on credit cards – a huge saving for merchants. This cost reduction directly improves merchants’ profit margins on every sale.

Faster Settlement and Improved Cash Flow: Unlike card payments that settle in days, stablecoin payments settle nearly instantly with finality. Retailers get their money right away, which means better cash flow management. They also avoid the risk of chargebacks or payment reversals, since crypto settlements are irreversible. Quick access to funds can be particularly beneficial for small businesses or those with tight working capital, and it allows earning interest sooner on revenues that would otherwise sit in transit.

New Revenue from Float and Financial Services: If companies issue their own stablecoin, they can invest the reserve funds in short-term instruments like Treasuries and earn interest. Even if they don’t issue a coin, accepting stablecoins means they might hold some crypto liquidity that could be put to work. Additionally, stablecoins open the door to creative loyalty programs (e.g. rewarding customers in stablecoins, or paying interest on customer balances if regulations allowed). This effectively lets non-bank companies participate in financial services income streams. A retailer consortium coin, for instance, could collectively save billions in fees and generate billions in interest that used to go to banks.

Programmability and Innovation: Stablecoins are programmable money. Businesses could design payments that integrate with smart contracts – enabling new commerce models like automated escrow, dynamic pricing, or instant supplier payments upon sale. They also make cross-border transactions easier; a U.S. dollar stablecoin can be sent globally in minutes without currency conversion, which could streamline international e-commerce or supply chain payments. Companies like Visa have noted that stablecoins facilitate 24/7, efficient cross-currency swaps and could be the backbone for next-gen payment networks.

Given these benefits, it’s no surprise that many major players are testing the waters. PayPal, for example, launched its own U.S. dollar stablecoin (PYUSD) in 2023 – fully backed by dollar deposits and short-term Treasuries – to integrate crypto payments into its platform. PayPal’s stablecoin allows users to buy, sell, and transfer digital dollars within the PayPal app, and the company sees it as a tool for faster transactions and eventually payments to merchants. Meanwhile, Visa has been actively piloting the use of stablecoins for settlement. In 2021, Visa started a program to settle certain B2B payments using USDC (USD Coin) instead of traditional bank wires, initially on Ethereum. By 2023, Visa had expanded stablecoin settlements to the Solana blockchain (a faster, lower-cost network) and reported that it had already processed over $225 million in USDC transactions for cross-border payments in these trials. Visa’s head of crypto CEMEA region remarked in 2025 that “every institution that moves money will need a stablecoin strategy,” highlighting that even incumbent payment companies view this as a fundamental shift in the industry. Similarly, Mastercard has been exploring stablecoin and CBDC integration, partnering with crypto firms to enable direct stablecoin payments that could bypass the need for bank intermediaries. This “if you can’t beat them, join them” approach from payment networks underscores how disruptive stablecoins could be to the status quo.

However, businesses also recognize challenges in adoption. Perhaps the biggest question is consumer acceptance. For a customer, using a credit card is extremely convenient – it provides rewards, fraud protections, and essentially a short-term loan (you pay your bill later, not at the moment of purchase). Asking consumers to switch to paying with stablecoins means asking them to pre-fund a digital wallet or account with tokens and forego some of those credit card perks. As one analysis put it, shoppers might need convincing: a stablecoin acts like a prepaid debit, requiring you to estimate and load what you plan to spend, whereas credit cards let you spend now and pay later. To overcome this, companies would likely have to offer incentives or rewards to nudge users into trying stablecoins. We may see discounts for paying in a retailer’s coin, or loyalty points, cash-back in stablecoin, etc. (much like how some gas stations give a discount for cash payments). Starbucks’ successful app is a proof of concept: by offering rewards, Starbucks got millions of customers to preload money into the app (effectively a digital stored-value card) – at one point holding over $1.5 billion in customer balances that function like Starbucks-only stablecoins. That shows people will hold and use a private digital currency if the perks are attractive. Big retailers could replicate this model with stablecoins, for instance by giving extra points or special deals to those who pay with “Walmart Coin.” Indeed, Walmart has experimented in the past with incentives on its prepaid value cards, even adding lottery-like prize opportunities to encourage uptake. Such creativity would likely be needed to drive mass adoption of retailer-issued stablecoins in face of the credit card habit.

Another consideration is the reaction of banks and the broader financial system. If consumers and businesses shift toward stablecoins, banks stand to lose out on deposits and payment fees. Money that sits in a Walmart or Amazon coin wallet is money not sitting in a traditional bank account. If that happens at scale, banks could see a shrinking pool of low-cost deposits (which they lend out for profit) and might have to raise interest rates on deposits to compete with the yields and convenience of stablecoins. Moreover, banks earn substantial revenue from interchange fees via their issued credit/debit cards – revenue which would diminish if stablecoin payments reduce card usage. Not surprisingly, banks have lobbied against expansive stablecoin use, and they may respond by launching their own digital dollar tokens or integrating with upcoming Fed-issued digital currencies to stay relevant. In fact, we’re already seeing early moves: JPMorgan created JPM Coin (a private, permissioned stablecoin for institutional clients) to streamline global transfers, and a consortium of U.S. banks is exploring a deposit-backed stablecoin network (the USDF project) to enable bank-issued tokens. These efforts indicate that the banking sector is looking for ways to participate in – or at least not be displaced by – the stablecoin boom.

In summary, large U.S. businesses are keen on stablecoins because they promise to cut payment processing costs, speed up cash flow, and even open new revenue streams. Heavyweights like Walmart, Amazon, PayPal, Visa, and others are actively researching or piloting stablecoin solutions. For potential investors, this signals that stablecoins are moving from a crypto niche to a mainstream fintech innovation. If even a fraction of the trillions in retail and e-commerce sales were to be conducted via stablecoins, it would mark a significant shift in the payments landscape – with winners being the companies that adopt efficiently, and losers being those clinging to fee-laden legacy systems.

Stablecoin Adoption and Additional Demand for U.S. Treasuries

One often overlooked implication of widespread stablecoin adoption is its impact on the U.S. Treasury market. Because USD-backed stablecoins must hold reserves in safe assets, a large-scale expansion of stablecoins would directly translate into increased demand for instruments like Treasury bills (T-bills). In essence, stablecoin issuers have emerged as a new class of big buyers in the market for U.S. government debt, and that influence will grow if corporate America aggressively implements stablecoin payments.

Figure: Reserve asset breakdown of a major USD stablecoin (Tether, as of a recent report). Over 80% of Tether’s $149 billion in reserves are held in cash and cash-equivalent assets, with about 81% in U.S. Treasury bills (green) and much of the rest in short-term secured loans and other deposits. This highlights that leading stablecoins are effectively backed predominantly by U.S. government debt, using ultra-safe assets to maintain their $1 pegs.

As shown above, top stablecoins like Tether and USDC keep a large portion of their collateral in U.S. Treasuries – primarily T-bills and overnight repo agreements backed by Treasuries. This is done for safety and liquidity, since T-bills are considered virtually risk-free and easily sold or matured to meet redemptions. Tether, the largest USD-pegged stablecoin issuer, reportedly had about $113 billion of Treasury holdings in 2024, making it the seventh-largest holder of U.S. Treasuries globally. To put that in perspective, a single crypto company was holding as many T-bills as a mid-sized foreign central bank – comparable to the holdings of countries like South Korea or Saudi Arabia. Combined with Circle (issuer of USDC), the two largest stablecoin issuers at one point held around $166 billion in U.S. government debt by mid-2025. This trend has accelerated as stablecoin providers moved to strengthen their reserves (for instance, after some stablecoins briefly lost their peg during market stress in 2022, issuers shifted even more reserves into short-term Treasuries to bolster confidence).

If U.S. companies drive a new wave of stablecoin adoption, the total outstanding stablecoin supply could grow dramatically, and with it the reserves (and Treasury holdings) needed to back those coins. Scenario analyses by market experts and government advisors suggest a potentially huge expansion. The U.S. Treasury’s Borrowing Advisory Committee (TBAC) – a group of senior financial industry executives that advises on debt management – discussed stablecoins in its April 2025 meeting. Their report projected that under favorable conditions (e.g. the GENIUS Act passing, and broad adoption by fintechs and merchants), the stablecoin market could reach roughly $2 trillion in circulating supply by 2028. This would be an astonishing growth from roughly $234 billion in early 2025, implying about an 8-fold increase in three years. To support that level of stablecoins (while keeping the 1:1 peg), issuers would need to hold on the order of $1 trillion or more in high-quality liquid assets, primarily Treasury bills. In other words, a full-scale mainstreaming of stablecoins could create an additional $800+ billion of demand for U.S. Treasuries (above current holdings) over the next few years. One research estimate called this a potential “$900 billion demand shock” to the T-bill market from stablecoin growth alone.

To appreciate the magnitude: if stablecoin issuers did end up holding over $1 trillion in Treasuries, they would collectively own more U.S. government debt than major foreign creditors like China or the UK. In fact, at $2T stablecoin supply (with >$1T in T-bills backing it), stablecoin providers could become the second-largest holder of U.S. Treasuries, behind only Japan (which holds about $1.1T), surpassing China (~$0.8T). Bank analysts at JPMorgan have likewise noted this trajectory, predicting that stablecoin issuers may soon rank among the top three buyers of Treasury bills worldwide. This influx of new demand is viewed by some as a boon: it creates a fresh, sizable buyer for U.S. debt at a time when official foreign purchases have waned. In recent years, countries like China and Russia have reduced their Treasury holdings for political or economic reasons, and there’s been concern about who will absorb the ever-increasing U.S. debt issuance. Stablecoin reserves could fill part of that gap. The TBAC report explicitly suggested that stablecoins could “materially heighten demand” for T-bills and help finance U.S. deficits by broadening the investor base. More demand for Treasuries, all else equal, means the government can issue more short-term debt without stressing the market, potentially putting downward pressure on short-term yields (benefiting U.S. borrowing costs). It also diversifies ownership of the debt: instead of relying as much on foreign central banks, the U.S. would be funded in part by a domestic, tech-driven sector aligning with dollar stability interests. In this sense, policymakers see a strategic advantage – one reason the previous U.S. administration highlighted stablecoins as a tool to reinforce U.S. dollar dominance globally.

However, this growing interdependence between stablecoins and the Treasury market is not without risks. Liquidity and stability in one market now can affect the other. Treasury bills are normally very liquid and safe, but there have been episodes of illiquidity or volatility (for example, the repo market scare in 2019 or the pandemic turmoil in March 2020). If a major stablecoin experienced a crisis – say, a loss of confidence leading to mass redemptions – the issuer might need to suddenly liquidate tens of billions in T-bills to raise cash. A fire-sale of such assets could depress Treasury prices (spike yields) and ripple through the broader financial system. Analysts warn that in a worst-case scenario, a stablecoin “bank run” and forced asset dump could disrupt the short-term funding markets, given the sheer scale of holdings. Conversely, if the Treasury market had a hiccup (say a sudden jump in yields or a liquidity freeze in a crisis), that could threaten the value of stablecoin reserves and potentially break the token pegs if not managed, thus “implicating Treasuries in any stablecoin crisis”. In essence, stablecoins and Treasuries are becoming a tightly coupled system – stablecoins rely on Treasuries’ safety, and now Treasuries rely on stablecoins as a large investor – which means shocks in one could transmit to the other. Regulators are aware of this and likely to impose safeguards (for example, requiring stablecoin issuers to have robust liquidity risk management, perhaps access to Fed backstops in extreme cases, similar to how prime money market funds have regulations after the 2008 crisis). The pending legislation would mandate monthly disclosures of reserve composition and perhaps oversight of how reserves are managed to mitigate these risks.

Another macroeconomic effect of widespread stablecoin use is the potential impact on banks and money markets. As mentioned earlier, if consumers hold a lot of value in stablecoins (say in an Amazon wallet) instead of bank deposits, traditional banks could face a disintermediation of deposits. Less deposit funding means banks might curtail lending or raise interest rates to attract funds back, which could tighten credit conditions or squeeze bank profit margins. In this sense, stablecoins compete not just with payment networks but with bank accounts and money market funds, particularly if stablecoin issuers start sharing some yield with users (one reason the GENIUS Act seeks to prohibit stablecoin issuers from directly passing on interest – to prevent an unchecked flight of deposits to higher-yielding stablecoins). The interplay is complex: stablecoins could push banks to innovate (maybe offering their own digital dollars or higher rates), and could even lead to closer partnerships (banks could become custodians or reserve managers for stablecoin issuers, as a new line of business). The Federal Reserve is also watching this space; if privately issued stablecoins grow too large, the Fed might respond with its own central bank digital currency (CBDC) or stricter regulations to maintain control of the money supply and financial stability.

From an investor’s perspective, the scenario where U.S. companies aggressively implement stablecoin payments is a double-edged sword for markets. On one hand, U.S. Treasuries could see a surge in demand, supporting high bond prices (low yields) in the short-term segment. Some analysts suggest this additional stablecoin-driven demand for T-bills could lower short-term borrowing costs for the government and even steepen the yield curve if Treasury shifts issuance toward more bills and fewer long bonds. It effectively creates a new, captive buyer for government debt, which could be a relief as deficits remain large. On the other hand, it introduces a new contingency: Treasury market stability might become linked to the fortunes of the crypto market and retail adoption trends. For example, if stablecoin adoption plateaued or reversed (due to a regulatory shock or loss of trust), that could suddenly remove a large source of Treasury demand, at least temporarily. Additionally, investors in financial sector equities (like banks and card networks) need to consider how the payment revenue landscape might shift – with stablecoin-friendly firms potentially capturing value and traditional fee streams coming under pressure.

In conclusion, if U.S. companies push stablecoin payment offerings on a grand scale, we should expect a significant uptick in stablecoin circulation and thus in the reserves invested in U.S. Treasuries. Estimates run into the high hundreds of billions or more in new T-bill demand in the coming years. This development could strengthen the dollar’s ecosystem (by binding crypto liquidity to dollar-based assets) and provide the U.S. government with a broadened purchaser base for its debt. At the same time, it will require vigilant management of the link between digital currencies and traditional finance to ensure that stability is maintained. For potential investors, the key takeaway is that stablecoins are not just a fintech curiosity – they are poised to become an integral part of the financial infrastructure, influencing everything from retail payment costs to demand for Treasuries and monetary policy dynamics. Keeping an eye on legislative progress (such as the stablecoin bill), corporate adoption announcements, and the growth of stablecoin market cap can provide insight into how this trend might play out. The intersection of Big Tech, Wall Street, and government debt may seem an unlikely nexus, but stablecoins are bringing these domains together in unprecedented ways – and the coming years will show just how far this stablecoin-driven financial transformation goes.

Sources:

Chainalysis Team. Stablecoins 101: Behind crypto’s most popular asset. Dec 11, 2024chainalysis.comchainalysis.comchainalysis.comchainalysis.comchainalysis.com.

Brady Dale (Axios). Why retailers are looking into stablecoins. Jun 13, 2025axios.comaxios.comaxios.comaxios.comaxios.comaxios.comaxios.com.

Andrew Kessel (Investopedia). Why Walmart and Amazon Are Reportedly Considering Their Own Crypto Stablecoins. Jun 13, 2025investopedia.cominvestopedia.cominvestopedia.com.

Emily Mason (Bloomberg Law via AllSides). Retailers Seen Using Stablecoins to Push Back Against Card Fees. Jun 14, 2025news.bloomberglaw.comnews.bloomberglaw.com.

Hannah Lang & Davide Barbuscia (Reuters). Stablecoins’ step toward mainstream could shake up parts of US Treasury market. Jun 6, 2025reuters.comreuters.comreuters.com.

Nate Luce (Vanderbilt Law). The Risks and Rewards of the Growing Relationship Between Stablecoins and the U.S. Treasury Market. Jun 18, 2025law.vanderbilt.edulaw.vanderbilt.edulaw.vanderbilt.edulaw.vanderbilt.edu.

Michael Lebowitz (Real Investment Advice). Stablecoins to the Treasury’s Rescue. Jun 4, 2025realinvestmentadvice.comrealinvestmentadvice.comrealinvestmentadvice.comrealinvestmentadvice.comrealinvestmentadvice.com.

James Morales (CCN). Visa: “Every Institution That Moves Money Will Need a Stablecoin Strategy”. Jun 19, 2025ccn.comccn.comccn.com.

PayPal Press Release. PayPal Launches U.S. Dollar Stablecoin (PYUSD). Aug 7, 2023newsroom.paypal-corp.com.

Art for today: Daisies and Cornflowers, oil on panel 12x12 in.

All this smells like cbdc end game

They're going to ban cash and force us into CBDCs, I will not comply.